December 16, 2020A tax accountant is a highly trained professional that specialises in the analysis and preparation of tax statements on the behalf of businesses and individuals. There is no shortage of reasons why someone should seek the services of a tax accountant, and if you are located in the Ballarat area, there is only one place...

Read more

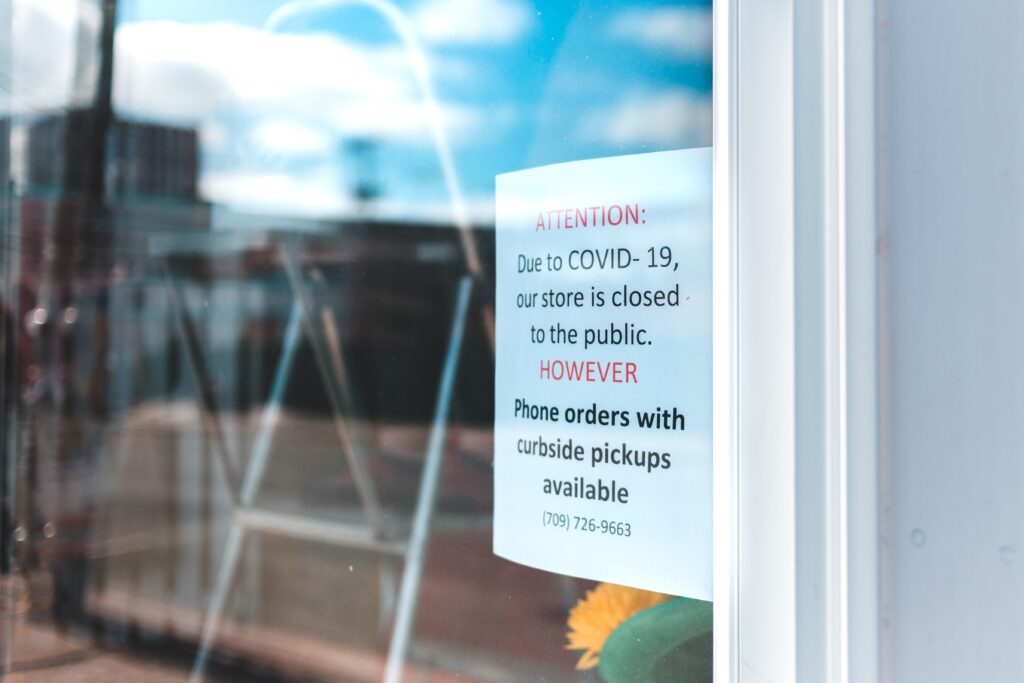

October 1, 2020The Coronavirus outbreak has hit small businesses hard, putting them under a level of stress like never before. Accountable Business Solutions provide businesses in Ballarat and Bendigo with comprehensive bookkeeping services to help keep them survive through COVID-19. In order to stay afloat a time of crisis, businesses must remain on top of the numbers...

Read more

September 14, 2020In this time of global pandemic, the Australian government has announced that they are providing cash flow boosts of amounts between $20,000 and $100,000, in order to support Ballarat and Bendigo small to medium businesses. Applying for a cash flow boost can be a complex process, which is why Accountable Business Solutions are offering valuable...

Read more

September 1, 2020Does your Bendigo business qualify for JobKeeper this second time round? Accountable Business Solutions are here to help you find out. In this time of global pandemic and economic distress, it is more important than ever for small businesses support each other, which is why we are offering small to medium businesses in Bendigo assistance...

Read more